Are you ready to save thousands in your business?

Unlock the Power of Clean-Up Bookkeeping

The Key to Financial Success for Small Service-Based Businesses

Are you a 6 figure+ business owner but you have no idea what your PRFOIT is? Then this is for YOU!

Seize your Financial Destiny!

Unlock the power of Clean-Up bookkeeping and take control of your financial destiny. Act now to secure your spot, optimize your tax strategy, and save big!

Maximize Tax Savings

Clean-up bookkeeping ensures accurate financial records, uncovering tax deductions and credits you might have missed. Keep more money in your pocket during tax season.

Financial Clarity

Gain a crystal-clear view of your business's financial health with real-time financial statements. Know where every dollar is going and make informed decisions for growth.

Time Changes

Free up your precious time by outsourcing bookkeeping tasks. Spend less time on paperwork and more on what truly matters - growing your business.

Avoid Costly Mistakes

Our expert bookkeepers ensure compliance, helping you avoid costly mistakes and penalties. Your records will always be accurate and up to date.

Improved Cash Flow

Keep your cash flow in check with proper bookkeeping. Ensure you always have the funds you need to cover expenses and seize growth opportunities.

Strategic Insights

Gain valuable insights into your financial trends and performance. Make data-driven decisions and plan for a successful financial future.

Ready to buy our Clean-Up Bookkeeping so that you start your tax savings?

Get 60% OFF Clean-Up Bookkeeping when you act NOW!

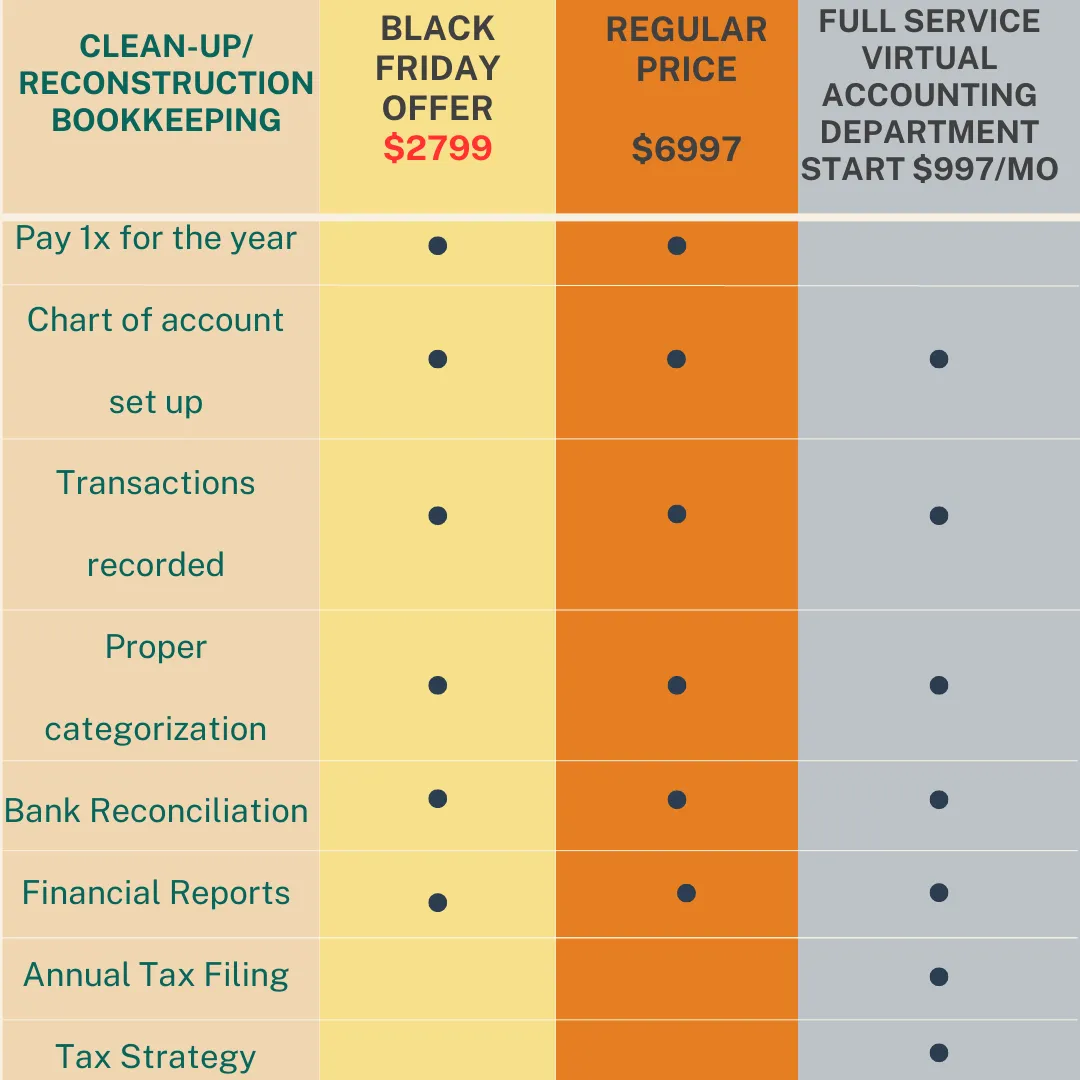

Black Friday Deal

$2,799 (1 time payment)

Chart of Account Set-Up

12 month categorization

12 month reconciliation

Full Year Financial Report

Regular Price

$6,997 (1 time payment)

Chart of Account Set-Up

12 month categorization

12 month reconciliation

Full Year Financial Report

Who Is Our Annual Reconstruction Bookkeeping For:

Small Business Owners

Service-Based Businesses

Seekers of Financial Clarity

Whether you're a professional seeking enhanced productivity, a consumer looking for a reliable and accessible option, our service is tailored to meet your requirements.

Frequently Asked Questions:

Question #1 - Q: How does the Black Friday deal work?

A: If you are a service based business and need your 2022 or 2023 clean-up bookkeeping prepared, you can sign up for this offer and have all 12 months completed for 1 price. If you sign up before Black Friday the price is 60% off for $2799, 50% off for $3,499 on the weekend and 40% off for $4,198 for Cyber Monday.

Question #2 - Q: How does Clean-Up or Reconstruction Bookkeeping benefit my business's tax strategy?

Bookkeeping plays a pivotal role in optimizing your tax strategy. By maintaining accurate and up-to-date financial records, we can identify all eligible deductions, credits, and tax-saving opportunities. This ensures you keep more of your hard-earned money during tax season and have a solid foundation for strategic tax planning.

Question #3 - Q: What is the Year End Tax Assessment, and how does it work?

The Year End Tax Assessment is an exclusive bonus offered to the first 5 customers who purchase our Reconstruction Bookkeeping services. It's a personalized evaluation of your financial situation at the end of the year, aimed at identifying potential tax-saving strategies for the following year. Our experts will review your financial records, assess your tax liability, and provide tailored recommendations to help you reduce your tax burden in 2023. It's our way of going the extra mile to ensure you get the most out of your tax strategy.

*Please note that this offer is only for NEW Clients that are service-based business (with no inventory) and have less than 4 bank accounts - more accounts will have an additional costs

Meet the owner

A Word From The CEO

Hey There! I'm Atiya!

I have helped my #SavvyFamily save over $7MM in tax savings since 2021 alone!

I am a dually licensed CPA (Canada and the USA) with 18 years of tax experience. I help service based business owners by reducing their tax burden to save them money.

I have a goal of saving my Savvy Family (aka my clients) over $1 Billion in tax savings.

Let me save you thousands and welcome you to be part of the Savvy Family!

Get 60% OFF

Reconstruction/Clean-Up Bookkeeping when you act NOW!